|

Is this email not displaying correctly? Click here to view in browser Issue 17 | September 2023 |

|

Budget Execution is central to the delivery of services at the lowest level By Medard Kaganzi, Research Intern, ACODE

By Medard Kaganzi, Research Intern, ACODE

Budget execution is at the core of government businesses globally and also quality budget execution is measured in terms of a government's ability to accurately hit its own revenue and service delivery targets. In a study on the effect of budget execution on service delivery, Ejang, M. et al (2022) observed that budget performance affects service delivery. Qazi et al., (2016), also observed that improving service delivery requires allocating sufficient budget resources that bridge gaps between budget performance monitoring and planned activities1. In budget execution, spending often fails to meet expected performance and it is important to differentiate the source of this performance failure to specify the cure. In this case, efficient budget execution should be2.

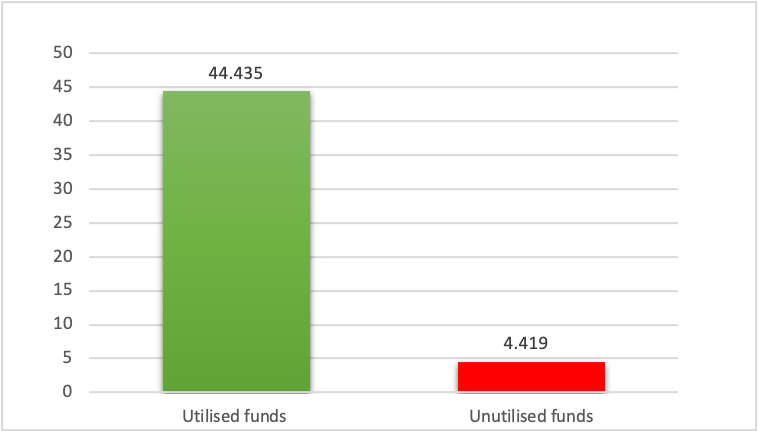

In Sub-Saharan Africa, Uganda inclusive, one of the leading causes of poor budget execution is low absorption. This continues to be a persistent challenge amidst the deficit budgets these countries run. Low absorption means that a significant portion of government funds earmarked for a specific program or project remains unutilized within a designated financial year. According to MoFPED FY 2020/2021, a total of UGX 589 billion unspent money was returned by LGs to the Treasury3. The following financial year (FY 2021/22) the OAG Annual Report (2021) shows that UGX 587 Billion was returned by LGs again. However, we should note that Section 17 (2) of the Public Finance Management Act (2015 as amended) requires that all LGs that fail to spend money appropriated are to return it to the Consolidated Fund at the end of the fiscal year4. This article, therefore, explores the challenge of low absorption during budget execution and its impact on service delivery. In the year 2010, Uganda embarked on a journey to attain middle-income status by coming up with a development policy framework known as Vision 2040. This is to be achieved through a series of medium-term expenditure frameworks –the National Development Plans (1, 2, and 3). However, this target is failing to realize expectations due to a series of continuous failures to attain the medium-term targets caused by such budget execution shortfalls. Over time, Uganda’s Central and Local administration units have persistently grappled with inadequate funding but amidst the inadequate funds, poor absorption makes it dire. It is important to note that some of these appropriated funds in the budget are loans that must be paid back with interest and currently debt servicing and Repayment takes up about 9 trillion which is about 16% of the whole 2023/24 financial year budget. A look at the Auditor General’s Report FY 2021/2022 , shows that Parliament passed a UGX 51.562 Trillion budget to finance Government expenditure. However, the warranted (released) funds were UGX 48.854 Trillion. And the actual expenditure was UGX 44.43 trillion. This means that unutilized funds were UGX 4.419 Trillion which amounts to about 9% of the total released funds as illustrated in Figure 1 below:6 Figure 1: Level of Utilization of Funds (in Trillion Shillings)

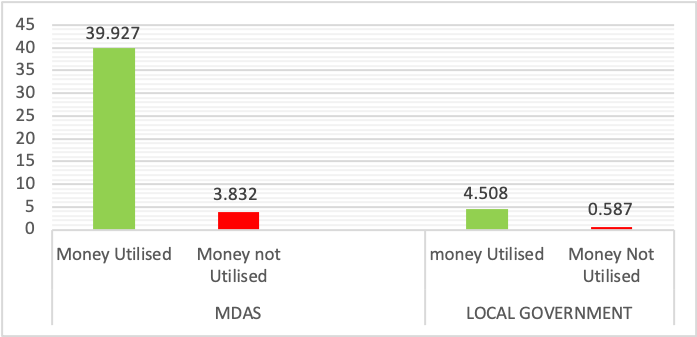

Source: Auditor General’s Report for the Financial Year 2021/2022 Furthermore, the Auditor General’s Report reveals that MDAs returned UGX 3.832 trillion (about 9%) out of the UGX 43.759 trillion warranted. This implies that MDAs only utilized UGX 39.927 trillion (91%)7. local governments spent UGX 4.508 trillion out of the UGX 5.095 trillion warranted (released) funds. This means that Local Governments returned UGX 0.587 Trillion (587 Billion) as illustrated in Figure 2. Figure 2: Utilized Funds in MDAs and LGs in FY 2021/22 in Trillion Shillings

Source: Auditor General’s Report for the Financial Year 2021/2022 Furthermore, the same Report revealed that 121 of 130 districts all over the country received 100% funding for the wage bill as requested, but only 11 of 130 districts had an absorption of 100%. Terego District registered the worst performance at a 63% absorption rate. This article therefore observes contributing factors to the low absorption capacity of funds during the budget execution process some of which include:

RecommendationsTo improve budget execution and absorption, especially at both MDA & LG levels, there is a need to consider the following:

ConclusionTo address the challenges associated with the low absorption capacity of funds during the budget execution process, a multi-faceted approach is necessary. By addressing bureaucratic inefficiencies, improving governance and coordination, investing in capacity building, ensuring timely fund disbursement, and simplifying procurement processes, governments can enhance their budget execution efficiency. These recommendations seek to create an environment where allocated funds are utilized effectively and interventions are implemented as planned, ultimately leading to improved public service delivery and developmental outcomes.

|

|

© 2023 Advocates Coalition for Development & Environment. All Rights Reserved

Plot 96, Kanjokya Street. Box 29836, Kampala-UGANDA

|

|

Not wanting to receive these emails? You can unsubscribe here |