|

Is this email not displaying correctly? Click here to view in browser Issue 17 | September 2023 |

|

Auditing in Budget Execution for effective service delivery By Richard Ayesigwa, Research Fellow & Peter Watuwa, Research Intern, ACODE

By Richard Ayesigwa, Research Fellow & Peter Watuwa, Research Intern, ACODE

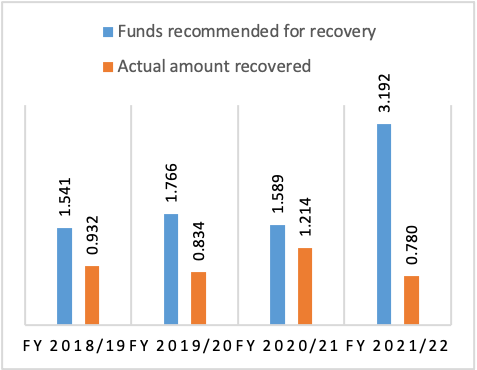

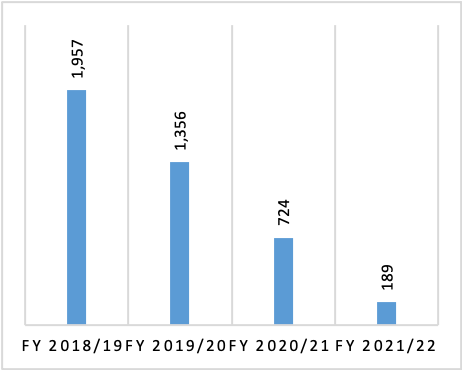

The 1st of July 2023 marked the start of the implementation of the new FY 2023/24 budget. While the budget preparation process has improved by leaps and bounds in terms of transparency, participation, and inclusivity, budget execution remains a challenge, especially in local governments which play a pivotal role in service delivery. At local government, avenues exist for influencing and popularizing the budgeting process, but the same cannot be said about the budget execution process although it has a more difficult responsibility to complete since it must give products and services to the community following the budget formulation stage. The existing internal controls that enable effective budget utilization at local governments are the internal Audit and monitoring which is the function of political leaders. Internal controls are aimed at ensuring financial discipline in local governments. Despite the internal controls, misappropriation of resources has continued to increase. According to the Inspectorate General of Government (IGG)1, although the number of corruption cases in local governments investigated has been reducing since FY 2018/19, the report shows that the amount recommended for recovery has been increasing from Ugx1.54 billion in FY 2018/19 to Ugx3.19 billion in FY2021/22.

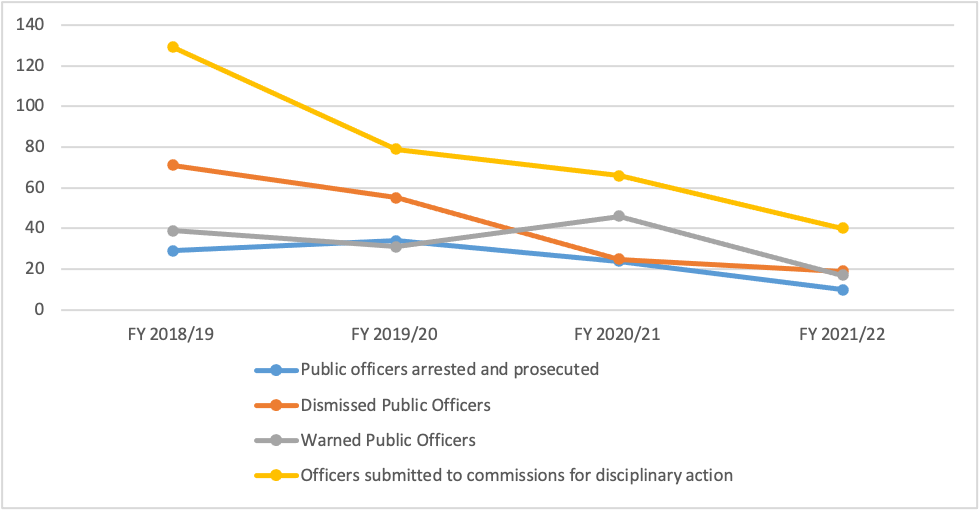

Source: Auditor General’s reports In addition, during the same period, the number of public officers arrested and prosecuted, dismissed, warned, and submitted to commissions for disciplinary action has been reducing despite the increase in the amount of funds misappropriated. Figure 3: Number of Implicated Local Government Officials and Actions taken

Source: Auditor General’s reports With the increase in corruption at the Local Governments despite the reduction in the number of corrupt officials, one can only reach the logical conclusion of the existence of systemic corruption. This systemic corruption thrives even if specific individuals are removed from their positions, leading to the ineffectiveness of the interventions. What are the gains?The President has frequently shown how committed the government is to fighting corruption. He declared a zero-tolerance stance against corruption in 2006, and in his 2019 State of the Nation speech2, Corruption was dubbed "Public Enemy Number One". While marking the 2021 Anti-Corruption Day3, the lifestyle audit was introduced by the president as an additional tool in the arsenal against corruption. Despite the clear political will and robust institutional and legal framework frameworks, different reports show that there is an upsurge in corruption in Uganda. Reducing corruption at the local government level requires a comprehensive and multifaceted approach that involves various structures. These structures include the Internal Audit, the Local Government Public Accounts Committee (LGPAC), the Ministry of Local Government District Executive Committee, and the District Councils. Although these structures have their unique challenges key being limited funding, political influence, and limited autonomy in the case of LGPAC, they can be strengthened to fight corruption at the local government. At local government, the internal audit is mandated to produce quarterly audit reports which are submitted to the Ministry of Local Government and LGPAC for discussion. The LGPAC may require the attendance of any councillor or officer to explain matters arising from the reports. This committee is required to submit its findings to the district council through the District Executive Committee for discussion and making recommendations. Although quarterly internal Audit reports are produced by most local governments to a larger extent, a study conducted by ACODE on the performance of statutory bodies of the district council found that more than 30% of the districts that participated had not reviewed any internal audit report in the entire FY2021/22. In addition, only 7 out of 26 LGPACs had regular meetings that is one meeting per quarter, and had timely produced the reports. Of these, only five districts submitted four reports to the MoLG in the financial year ending July 2022. Finally, the report found that only one LGPAC of Ntungamo DLG had evidence of action taken by council resolution relating to the operations of LGPAC. Failure by LGPAC to hold quarterly meetings to discuss internal Audit reports affects how they execute their roles. Also, if LGPAC does not execute its role, this means that DEC and the District Council will also not execute their roles allowing public officials to take advantage of such circumstances to mismanage public funds. What is known about Internal Audit and budget execution in Uganda?Uganda recognizes the importance of the internal audit function, which is why the function is established in Ministries, Departments, Agencies (MDA), and Local Governments (LG). Despite the provisions of enabling laws and public financial management frameworks and instruments, the utilization of public funds is still bogged with cases of colossal misappropriation. A Report by the Inspectorate General of Government (2022) for example found misuse of funds in most of the programs. The highest level of reporting for misuse appears to be in the Public Sector Transformation program. For example at the LG level, Ugx1 billion was paid to 795 dead or absconded beneficiaries over 16 months, 19 billion was paid to 609 ineligible primary and secondary teachers, Ugx3.5 billion was paid to 26 staff in LG using a forged salary scale and Ugx20.7 was illegally deducted from 15002 staff in 44 local governments among others. Similarly, Regulations 42 and 43 (2) of the Local Government Financial and Accounting Regulations 2007, require funds to be properly vouched and accounted for within a month. However, the Office of the Auditor General of Government (OAG, 2022)4 established that payments amounting to UGX.2.5 billion in 23 LGs remained unaccounted for by the close of the 2021/22 financial year. Furthermore, Regulation 11(d) of the Local Government Financial and Accounting Regulations, 20075 requires the head of finance to ensure that commitments are not approved unless there is sufficient and committed balance available. However, the OAG (2022) audit report on local authorities noted that several Higher Local Governments for the year under review failed to adhere to the commitment control system which has resulted in committing Councils beyond the available financial resources. Consequently, 3,002 Councilors in 36 districts were underpaid by approximately Ugx1.16 billion resulting in affecting the political oversight role of monitoring the implementation of local government programs thus affecting service delivery. The Public Procurement and Disposal of Public Assets (PPDA) Act 2003, and the Local Government PPDA Regulations 2006 require that all public procurement of goods, services, and works comply with the procurement law. However, the OAG report (2022) noted that several Local Authorities procured items and services worth Ugx4.64 billion without following Public Procurement Regulations and guidelines specifically obtaining clearance from the Community Project Management Procurement Committees. In addition, 250 million was awarded to a contractor with no capacity who subsequently abandoned the works. The OAG was of the view that there was a risk that value for money may not have been obtained. Internal auditing is expected to provide independent objective assurance and add value and improve LGs operations by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Despite the efforts to ensure that all local governments in Uganda are guided by the Local Government Act (1997)6 and the PFMA (2015), the PPDA Act, and LGFAR (2007), local governments are still faced with cases of abuse of financial accountability regulations that erode achieving value for money. The Office of the Auditor General of Government (OAG, 2022) has continuously highlighted some changeable financial reports relating to maladministration, unaccounted-for administrative advances, incompletely vouched expenditure, un-vouched expenditure, doubtful expenditure, over expenditure against budgets, failure to adhere to the commitment control system, procurement of items and services in contravention of the LG Acts and Regulations. The OAG has severally indicated there are risks in LG public budget execution where value for money may not guarantee. This implies that if this trend continues unabated, public resources locally generated and central government grants remitted to districts will be continuously misused with disastrous consequences for service delivery. RecommendationsThe Permanent Secretary/Secretary to the Treasury (PSST) should not appoint or designate persons as accounting officers where, according to the report of an Internal Auditor General or the Auditor-General, such persons have not accounted for the public resources or assets of the local government for a financial year. There is a need for the Chief Administrative Officer (CAO) to provide feedback to the LGPAC on the actions taken on the recommendations of the council concerning the LGPAC report. Priority should be given to financing operations of the internal audit, Local Government Public Accounts Committees (LGPAC), and Local government councils, to enable regular sittings to deliberate on audit reports and make timely independent findings. In conclusion, effective internal audit processes in budget execution are crucial for ensuring that public funds are used efficiently to deliver essential services. A quarterly review of the budget execution process can help decision-makers evaluate the performance of service delivery initiatives, enhance transparency and accountability, and optimize resource allocation and utilization. Ultimately, these efforts contribute to the overall improvement of service delivery and the well-being of citizens.

|

|

© 2023 Advocates Coalition for Development & Environment. All Rights Reserved

Plot 96, Kanjokya Street. Box 29836, Kampala-UGANDA

|

|

Not wanting to receive these emails? You can unsubscribe here |